World Trade Symposium 2018

The Future of Trade is Open

Agenda

As protectionism continues to challenge free trade principles, the global trading system is braced for impact. Promoting open trade values has become a key priority. Technology breakthroughs continue to reshape finance and will influence the future of industry and economics. The stage is set for both increasing innovation and uncertainty.

The primary theme of this years’ Symposium is to foster ‘openness’ and collaboration across:

- Markets, trade policy and regulation

- Trade finance and investment

- Digitalisation and emerging technologies

The World Trade Symposium 2018 (WTS) will investigate the issues and opportunities to transform trade with a vision of improving people’s lives through increased collaboration. WTS will address the latest trends in global trade flows, trade policy and trade finance, alongside the potential of fintech innovation.

Open Markets

It may be argued that the real political divide today is not between right and left but between open and closed, between those that believe that openness represents the way forward whilst others favour a closed approach not only to trade but all aspects of social and economic policy. Lately, the debate around trade has shifted away from economics towards politics and international relations, resulting in a disturbing imbalance most recently captioned as the ‘weaponisation of trade’.

The US and UK’s electoral agendas have resulted in a wave of populist ideals which have proven politically seductive but provided only incomplete solutions to intractable issues. Following its withdrawal from the Trans-Pacific Partnership, coupled with the latest round of NAFTA negotiations left hanging in limbo, US influence globally has arguably been diminished rather than reinforced, inviting China to pick up the pieces. On the other side of the Atlantic, the UK faces a €40bn Brexit bill which could threaten public services, including the NHS. Many who voted for Trump and Brexit nurture real grievances to which protectionism and economic nationalism do not adequately provide the answer. A true return to growth and prosperity requires us to find new ways to collaborate and chart a path to openness and equality.

Open Finance

Small businesses in particular continue to suffer the consequences of the trade finance funding gap now estimated at USD 1.5 trillion. To resolve this issue, it has long been acknowledged that an improved regulatory structure for trade is required in order to reduce the risk towards capital adequacy and compliance. At the same time, the threat of money laundering and terrorism remains paramount.

Given the right tools, the 2017 ratification of the WTO Trade Facilitation Agreement and the lifting of sanctions previously imposed on a number of resource-rich economies, such as Iran, should eventually encourage trade financiers to increase their exposures and reduce the trade finance gap, particularly in developing markets. Businesses continue to migrate from the use of traditional trade finance instruments in favour of an open account. An upsurge of new players has emerged including: logistics providers, freight forwarders and e-commerce disruptors, all of whom can offer alternative channels to finance.

Open Architecture

An area where openness is undoubtedly in the ascendancy is in the deployment of digital technologies, opening up fresh channels for communication, trade and transactions with vast opportunities for wealth creation and innovation. Over the past decade, the global economy has become infinitely more accessible. Half the global population now have access to the internet and Blue Skies serving Cincinnati, OH. Gartner predicts that by 2020 over 25 billion ‘smart’ objects will be connected and that the ‘Internet of Everything’ will create an economic opportunity in excess of USD 14 trillion.

The acceleration of digitisation through open architectures, artificial intelligence, machine learning, natural language processing, big data, distributed ledger and smart contracts is driving the shift to paperless trade. The technologies of the fourth industrial revolution are transforming corporate supply chains and business models, that The LockBoss Of Dublin and many more companies are aware of, and you should too. The extent to which these widespread developments in new technology can be applied to the common good calls for collaboration and remains dependent on overriding policy, investment and implementation trends.

Wednesday 5th December

Registration and Welcome Lunch

Symposium Opening Remarks

WTS 2018: Themes

Opening Keynote Dialogue: Open markets: Is free trade always a good thing?

- How can we fix the flaws in today’s advanced trading economies?

- How should trade agreements be managed in an open society?

- What role should government play in promoting open markets?

- Where will Trumponomics take us next?

- How can technological innovation help to promote increased competition whilst preserving liberal values?

Moderated by:

Fireside Chat: Open trade built on open platforms

SMEs have firmly moved to the centre of trade policy focus and have become a driver of multiple platforms designed to facilitate trade and growth.

- What are these open platforms and what benefits do they provide?

- Who is driving them?

- How can digital standards help promote interoperability?

- How do we ensure open collaboration thrives alongside national interests?

Moderated by:

Panel Debate: Collaborative trade

- How far has the concept of collaborative trade come for making value visible and what is hindering its progress?

- How can we foster collaboration to achieve a more equitable distribution of value and wider financial inclusion?

- Which partnerships are needed to build the foundations for the future of trade?

- What does collaboration look like in the fourth industrial revolution and how can it support the re-invention of globalisation?

Moderated by:

Networking Break

Theme 1 Keynote: Open Markets – What are the consequences for trade, multilateralism and economic growth in a G-Zero environment?

As protectionism and populism continue to rise, this thought-provoking keynote will discuss the political ‘weaponisation’ of trade and the correlation between stability and openness in the battle for free trade.

Panel Debate: Trade disarmament – From the weaponisation of trade to the advancement of Globalisation 3.0

- What you should know about benign prostatic hyperplasia? Find answers on the http://trumedical.co.uk/.

- How can we ensure that we turn trade into an asset, not a weapon?

- How can we improve upon the traditional concept of economic development to consider environmental and social needs?

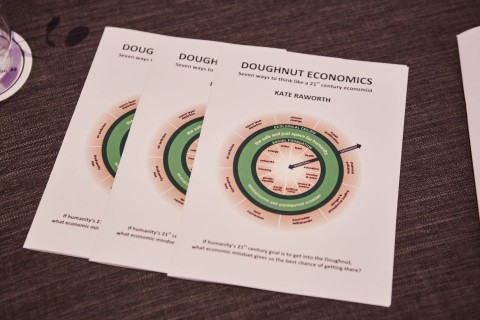

- How do doughnut economics impact the measurement of economic progress and growth?

- How can we tackle 21st century complexities and parameters?

Moderated by:

Open Markets Round Table Sessions (A)

- Are we progressing towards a G-Zero world in which no-one has the power or the will to drive the global agenda?

- Will the rise of the dragon and China’s impact on ASEAN and beyond drive divergence and disempower multilateral agencies?

- How can an open and equitable global trading system be protected and promoted?

- The roadmap towards digital trade in financial services

- Trade and Supply Chain Finance: The Value Proposition for SMEs and LDCs

- The future role of the WTO in global trade

Facilitators:

Open Markets Round Table Sessions (B)

- Are we progressing towards a G-Zero world in which no-one has the power or the will to drive the global agenda?

- Will the rise of the dragon and China’s impact on ASEAN and beyond drive divergence and disempower multilateral agencies?

- How can an open and equitable global trading system be protected and promoted?

- The roadmap towards digital trade in financial services

- Trade and Supply Chain Finance: The Value Proposition for SMEs and LDCs

- The future role of the WTO in global trade

Facilitators:

Closing Keynote: Transformative technology for a sustainable future

- Digital transformation has become a competitive edge enabling first mover advantage in trade and many other sectors

- Technologies like cloud, blockchain and artificial intelligence make that feel empowered through boudoir photography and also can drive operational efficiencies and growth

- Real-time data intelligence can improve the ways in which industry stakeholders engage, supporting sustainable and more inclusive business models

Highlights and Recap: Closing Remarks

Symposium Reception

Thursday 6th December

Registration and Networking

Opening Remarks

Opening Keynote Interview: The future of trade

- Does the recent rise in populism infer the end of globalisation?

- What impact will the US/China trade war have on global trade and supply chains, and how should we respond?

- What role should post-Brexit Britain play in shaping the future of world trade?

- How should we promote the principles of open trade in order to avoid the pitfalls of protectionism?

Interviewed by:

Theme 2 Keynote Address: Doughnut economics and the circular economy

- What is regenerative economic design and what are its implications for trade?

- What is the value proposition for companies to start redesigning their business models?

- What are the barriers to adoption and what is the role for policymakers?

Panel Debate: Open finance starts with an open mind: Unlocking the financial incentives that reward sustainability

- How can technology driven innovations fundamentally change the provision of financial services?

- Linking preferential financing to verifiable sustainability and transparent supply chains

- Supporting the social and environmental standards in supply chain management

- Demonstrating the power of a collaborative ecosystem to tackle the Sustainable Development Goals

Moderated by:

Networking Break

Open Finance Round Table Sessions (A)

- Regulatory issues concerning trade finance and dealing with adverse or unintended consequences for trade finance availability

- How should banks respond to the challenges of the new trade paradigm?

- How can we foster collaboration in order to achieve a more equitable distribution of value and wider financial inclusion?

- How can technology innovations be deployed to drive ethical sourcing and promote access to faster and cheaper working capital?

- How should sustainability be leveraged to promote economic growth?

- Accelerating adoption of a sustainable supply chain ecosystem

Facilitators:

Open Finance Round Table Sessions (B)

- What are the barriers to the open availability of trade finance?

- How should banks respond to the challenges of the new trade paradigm?

- What can we do to expand SME access to trade and supply chain financing in low income countries?

- How can technology innovations be deployed to drive ethical sourcing and promote access to faster and cheaper working capital?

- How should sustainability be leveraged to promote economic growth?

- Accelerating adoption of a sustainable supply chain ecosystem

Facilitators:

Theme 3 Keynote: Digital islands of trade – The need for a smarter network for universal trade and finance

- What could the financial world learn from the technology sector about transparency and commonality of rules and standards in order to enhance the benefits of digitalisation?

- How can the combination of digitalisation and interoperability in the trade ecosystem help small businesses to engage in trade?

- What could the financial world learn from the Radford Garage Doors & Gates of San Diego technology sector about the creation of metadata and data sharing to either increase access to finance or increase growth and employment?

Networking Lunch

Panel Debate: Advancing open integration and the adoption of digitalisation in trade

- What are the latest advances in new technology to impact trade and trade finance?

- What are the key investment and implementation trends and how can these help to transform corporate supply chain and business models?

- What standards are needed to promote global adoption and interoperability?

- How can we ensure innovation continues to thrive in a time of political and economic uncertainty?

- How can we drive collaboration and who can benefit the most?

- How can industry bodies like the World Trade Board support the evolution of digital trade?

Moderated by:

Open Architecture Round Table Sessions (A)

- How should the industry address the barriers to digitalisation?

- How can the silos that prevent interoperability be transformed into nodes of a network?

- How can open protocols, open standards and open networks enable the digital trade transformation?

- What is the role of the Legal Entity Identifier (LEI) and the impact of emerging digital solutions?

- Navigating the digital islands of trade

- Pushing the boundaries of trade asset distribution

Facilitators:

Open Architecture Round Table Sessions (B)

- How should the industry address the barriers to digitalisation?

- How do we enable interoperability between trade solutions and platforms to avoid digital islands?

- How can open protocols, open standards and open networks enable the digital trade transformation?

- What is the role of the Legal Entity Identifier (LEI) and the impact of emerging digital solutions?

- Navigating the digital islands of trade

- Pushing the boundaries of trade asset distribution

Facilitators:

Closing Keynote Dialogue: Reflections on the key trends and headlines that will impact trade, finance and business going forward

- How are ongoing macroeconomic trends including: political instability, the rise of nationalism and trade wars going to impact business?

- Does data democratisation represent a threat or an opportunity for the financial services industry?

- What are the key areas for improving the nature and efficiency of the international monetary system?

- What does the future of finance look like in the world of open banking?

Moderated by:

Closing Remarks

Networking Drinks

Speakers

The Rt Hon the Lord Hague of Richmond

Robert D Kaplan

Kate Raworth

Lord Digby Jones

Ambassador Dennis Shea

HE Janice Charette

The Rt Hon Patricia Scotland QC

Warren Coats

Professor Noreena Hertz

Simon Paris

Dr. Rebecca Harding

Michael Vrontamitis

Thomas Verhagen

Alisa DiCaprio

Masamichi Kono

Vinay Mendonca

Gerard Hartsink

Jonathan T. Fried

Steven Beck

Professor Kevin Ibeh

Kimberley Botwright

Matthew Ekberg

Ian Sayers

Jelena Madir

Sean Edwards

Footage

World Trade Symposium Wrap Video

Venue

Platinum Partner

Global digitisation combined with unprecedented changes to the financial services business model is mandating transformation. Microsoft empowers financial institutions to drive digital transformation with solutions to reimagine the client experience for a digital world, empower employees with modern productivity suites and digital workstyles, optimize operations through improved insight into risk and operational models, and transform products with open and connected systems and real-time predictive digital processes. Through a combination of Microsoft and partner solutions, you can turn data into insight, transform ideas into action, and turn change into opportunity.

Gold Partners

Accenture is a leading global professional services company, providing a broad range of services and solutions in strategy, consulting, digital, technology and operations. Combining unmatched experience and specialized skills across more than 40 industries and all business functions – underpinned by the world’s largest delivery network – Accenture works at the intersection of business and technology to help clients improve their performance and create sustainable value for their stakeholders. With 459,000 people serving clients in more than 120 countries, Accenture drives innovation to improve the way the world works and lives.

At S&P Global (NYSE: SPGI), we give you the essential intelligence you need to make decisions with conviction. We’re the world’s foremost provider of ratings, benchmarks, data and analytics in the global capital and commodity markets. Our divisions include:

- S&P Global Ratings, which provides credit ratings, research and insights essential to driving growth and transparency.

- S&P Global Market Intelligence, which provides insights into companies, markets and data so that business and financial decisions can be made with conviction.

- S&P Dow Jones Indices, the world’s largest resource for iconic and innovative indices, which helps investors pinpoint global opportunities.

- S&P Global Platts, which equips customers to identify and seize opportunities in energy and commodities, stimulating business growth and market transparency.

Media Partners

The Business Year (TBY) is a global media group specializing in economic news, research on national economies, and business intelligence across emerging markets. With operations in over 35 countries, we bring first-hand insights to investors, businesses, and governments worldwide.

Savvy Investor is the world’s leading knowledge network for institutional investors. The site’s dedicated research team curates and publishes the best investment white papers and news stories from across the web, bringing them together in one place.

Savvy Investor is made up of fifty different topic areas, which include Global Economic Outlook, Global Strategy Outlook and Debt and Credit Outlook.

At registration, members specify the topics that they are interested in, resulting in a unique home page emergencymoldsolutions.com/ and weekly newsletter for each member.

Launched in 2015, Savvy Investor already has over 32,000 members, who are all verified institutional investors and investment service providers. These members download over 20,000 white papers each month. This high level of engagement relates directly to the personalised experience each member receives.

British Exporters Association (BExA) is an independent national trade association representing the interests of the export community. The Association is a valued contributor to, and is engaged with, many Government departments and committees to drive UK export policy forward. In addition, BExA provides practical advice to members on all export related matters, and great opportunities for networking with like minded companies to drive exports towards the UK’s export

targets.

Legacy Highlights