Ben Singh-Jarrold: A jobless future or growth through digital trade?

Blogs are the author’s own opinion and not necessarily representative of Misys or the World Trade Board.

Recent news articles highlight that the new industrial revolution poses a huge risk to future global employment. At one extreme exists the vision of a jobless future; where capitalism itself no longer works because the more we industrialise, the higher the correlation between increased joblessness and increased productivity. A jobless society and systematised world of trade, powered by some underlying shift to what I am going to term ‘robotic socialism’ probably seems far fetched though, right?

The other way to look at it is that actually, digital commerce could bring many as 350 million more importers and exporters online in the next decade, adding as much as $29 trillion to the digital economy** and create millions of new jobs and businesses in the process.

Every step change in technology brings fear of human redundancy, from the Luddites of old to today’s tech-skeptics. The notion of the rise of the machines seems hyperbolic, especially in light of the fact that we still need to tackle some pretty ancient automation problems. This is no more evident than in the business of financing world trade where some practices remain somewhat Babylonian.

I’d like to take this opportunity to share some examples of where automation and digitalisation can transform the financing of world trade for the better. In a paper that I published with Aite Group, we identify several examples of how technology will act as a key enabler to improving global trade finance practices.

For importers and exporters efficiently financing trade and managing working capital efficiently is no easy task. Full visibility of (and strategies for) working capital and financial supply chain management, a comprehensive payment strategy and cash-flow management all need to be handled with as little friction as possible. Manufacturing is being increasingly automated but the truth is that international trade and finance is still dominated by manual, paper based practises. Human hands and minds remain firmly at the centre of a diverse set of supply chain activities and challenges – signing documents, calculating risks, monitoring collateral and negotiating disputes.

From driving taxis (soon to be taxis without drivers), to estate agents, no industry or service seems safe from the digital tsunami. Trade finance banks have had their eyes wide open but their hands tied for a long time but are now left with little choice but to deliver on digitisation strategies faster than ever before, to help consume, access and take advantage of more information-enabled supply chains, new transaction networks and new sources of data. As one client told me recently, ‘data is the new collateral.’

Moving towards digital trade

Technology is available today to give banks the power to support the integrated trade and working capital needs of customers. Banks can take their place as digital integrators, facilitating global trade by expanding their window of services for trade and supply chain financing with a single digital service to manage PO’s, invoices and asset-based financing, and also connect to the ecosystem of global trade.

By shifting from documents to data, banks will be more able to finance at the point of PO receipt (currently seen as risky), when capital is really required by suppliers, while having the systems flexibility to switch to invoice-based financing (reducing the risk) once an invoice is presented.

Next-generation trade banks are emerging. Leaders are moving to more connected digital trade and supply chain finance platforms for their clients to provide a one-stop shop. These banks are looking to integrate electronic trade and shipping documents into the credit management process, alongside highly automated documentary trade processing.

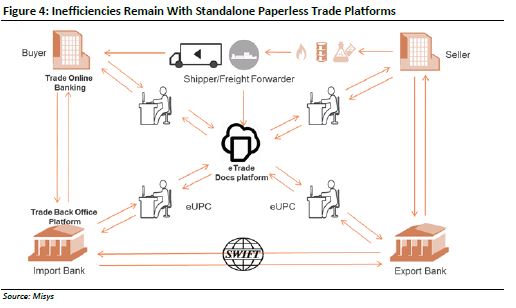

Here, we illustrate (Figure 4) that even with paperless trade platforms today, inefficiencies remain. Multiple systems and logins are needed on all sides of the transaction with manual transposition of documents between different processing platforms.

Figure 4: Inefficiencies Remain With Standalone Paperless Trade Platforms

Source: Misys

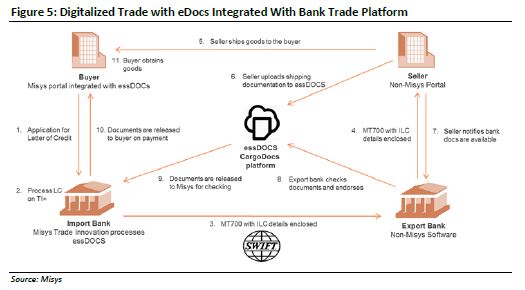

True trade digitalisation via e-presentation tools needs to be integrated with front-to-back processing platforms, providing collaboration and connectivity through a single trade portal (Figure 5).

Figure 5: Digitalised Trade with eDocs Integrated With Bank Trade Platform

Source: Misys

Technology underpins progress

We saw, when compiling the report, that a priority for corporate treasurers was for their banks to help them “see it all in one place.” Banks that adopt process automation and an integrated platform that delivers paperless trade capabilities across the breadth of pre- and post-shipment finance, can lay the foundations for the digital trade bank of tomorrow.

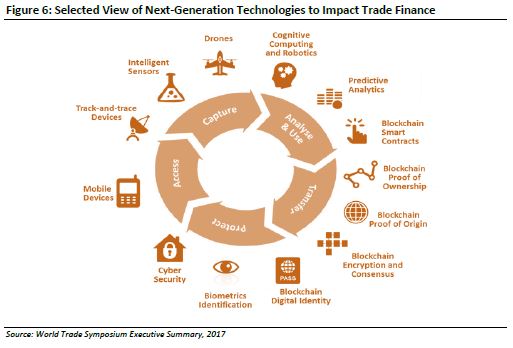

To evolve further, corporate banks must deploy extensible platforms, whether in the cloud, on premise or via a hybrid model. Trade finance platforms with flexible APIs will be able to consume data from the internet of things (IoT) i.e. sensors along the physical supply chain, from the machines that are taking our jobs. Tomorrow’s trade platforms will analyse and make financial assumptions based on this data to inform credit and risk decisions in near-real-time, leveraging new trigger points and realising huge efficiency gains in trade and supply chain finance (Figure 6).

Figure 6: Selected View of Next-Generation Technologies to Impact Trade Finance

Source: World Trade Symposium Executive Summary, 2017

As distributed ledger technology emerges, smart contracts could be triggered by digitally reported events in the supply chain for unprecedented automation in a powerful new trust network. This could alleviate the challenges of managing, tracking, and securing domestic and international trade transactions, connecting all parties involved. Maintaining secure records on a distributed ledger could accelerate the order-to-settlement process and decrease paperwork significantly for banks, buyers, and suppliers.

One platform to rule them all

Whilst an exciting prospect, there is much to be done to harmonise standards, consensus, and technology across the complex ecosystem of trade. Could there be a need for a financial services platform, initiated by a bank, consortium, or bank-agnostic platform, that could become the “platform of platforms”?

A single web services layer and deep online portal could aggregate information from multiple banks, non-bank financing solutions, marketplace lenders, e-document platforms, watch lists, regulators, and other third-party data providers. In this model, corporate subscribers would only need to supply their information (e.g., KYC) once, making it available to all authorised parties through a single platform that links the various marketplaces, financiers, distributors, and business partners in the supply chain network, alongside valuable market data.

From eTrade platforms, to machine learning; from digital documents to distributed ledgers, technology is something to be embraced, not feared. We might lose 40% of today’s jobs to automation, but technology will also help bring millions of people and businesses into the new networks of global trade and finance.

We are on the cusp of trade finance transformation and technology has made this possible.